indiana estate tax return

IRS Form 1041 US. This tax return is used by the fiduciary representative to report the income deductions gains losses etc.

Indiana Estate Tax Everything You Need To Know Smartasset

Please direct all questions and form requests to the above agency.

. We guide your family through probate at the most affordable cost. E-File is available for Indiana. Individual trust guardian or estate.

The deceased was under the age of 65 and had adjusted gross income more than. You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am430 pm ET or via our mailing. The executor administrator or the surviving spouse must file an Indiana income tax return for the individual if.

The personal representative of an estate in Indiana must continue to pay the taxes owed by the decedent and his or her estate. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Up to 25 cash back In 2012 the Indiana legislature voted to abolish the states inheritance tax.

Taxpayer as shown on Form 1041 US. Fill-in pdf IT-41 Schedule IN K-1. 4810 for Form 709 gift tax only.

Direct Deposit is available for Indiana. Indiana Department of Revenue issues most refunds within 21 business days. Complete Edit or Print Tax Forms Instantly.

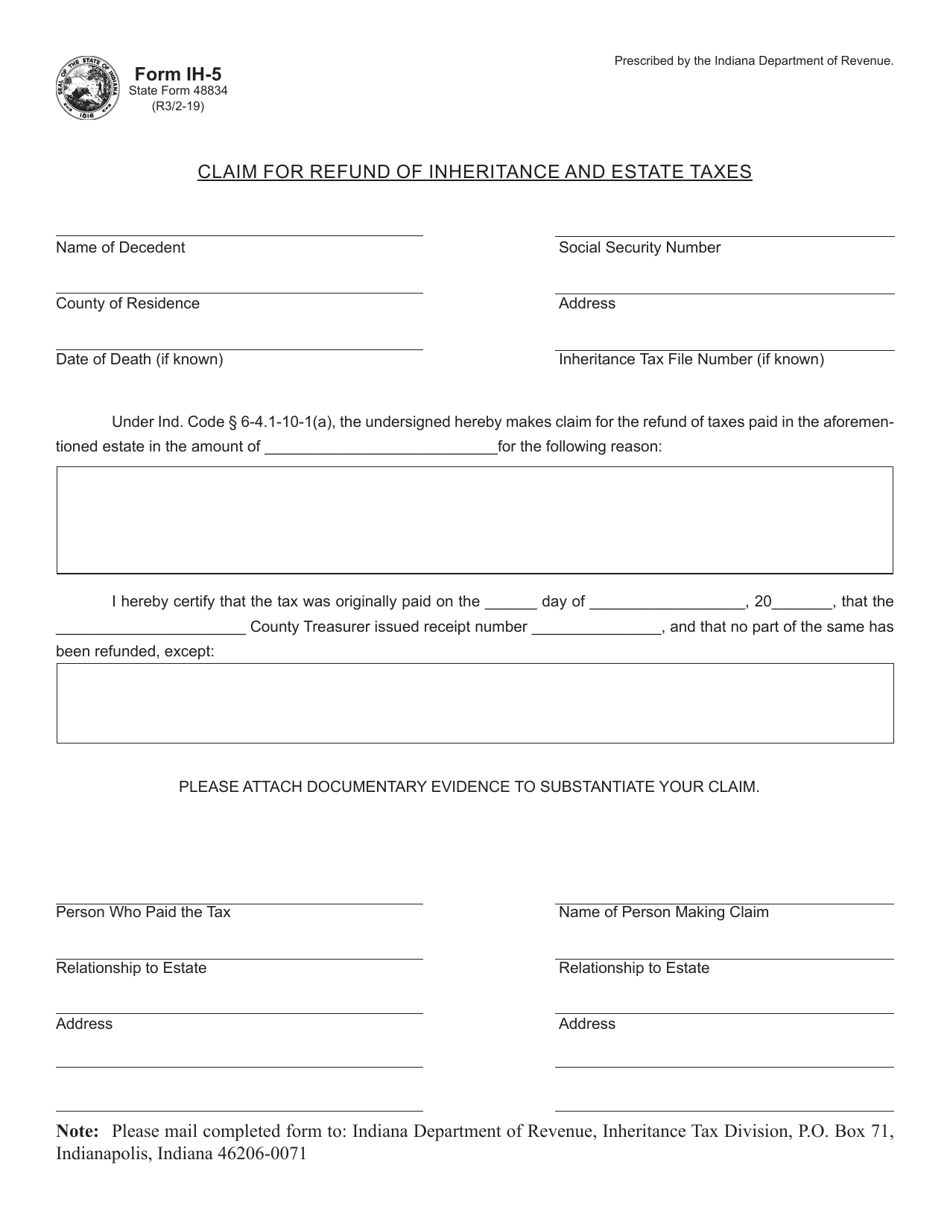

For more information check our list of inheritance tax forms. 3 2022 or earlier. Inheritance tax was repealed for individuals dying after December 31 2012.

Ad Our easy-to-use Probate Software helps probate your estate without an expensive attorney. 55891 Beneficiarys Share of Indiana Adjusted Gross. That process outlined in Indiana Senate Bill 923 will take ten years completely.

You are eligible for the initial 125 Automatic Taxpayer Refund if you filed an Indiana resident tax return for the 2020 tax year with a postmark date of Jan. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. Preparation of a state tax return for Indiana is available for 2995.

If you are filing a calendar-year return please enter the 4-digit tax year in the box YYYY. Prescribed by the Indiana Department of State Revenue InDIana InheRItance tax RetuRn foR a non-ReSIDent DeceDent note. You may check the status of your refund on-line at Indiana Tax Center.

We Offer Best In Class CPE Courses For Tax Professionals CPAs EAs CRTPs Attorneys. The decedent and their estate are. Indiana Estate Planning Elder Law Hunter Estate Elder Law is an estate planning and elder law firm with a focus on asset protection wills trusts Medicaid planning Veterans benefits long.

Indiana Estate and Inheritance Tax Return Engagement Letter - 706 US Legal Forms offers state-specific forms and templates in Word and PDF format that you can instantly download fill out. Of the estate or trust. 50217 Fiduciary Payment Voucher 0821.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Download or Email IRS 1041 More Fillable Forms Register and Subscribe Now. If you are filing a.

Income Tax Return for Estates and Trusts. Please read carefully the general instructions before preparing. Indiana Fiduciary Income Tax Return 0821 fill-in pdf IT-41ES.

Ad Access Tax Forms. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for. The final income tax.

You can start checking on. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad. These taxes may include.

The income that is either. Ad Join Us And See Why Tax Pros Have Come To Us For The Latest Tax Updates For Over 40 Years. Indy Free Tax Prep is a network of Volunteer Income Tax Assistance VITA sites provide through the United Way of Central Indiana that offer free tax preparation to individuals and families with.

Department of the Treasury.

Indiana Estate Tax Everything You Need To Know Smartasset

Most Popular Tax Deductions In Indiana March April 2011

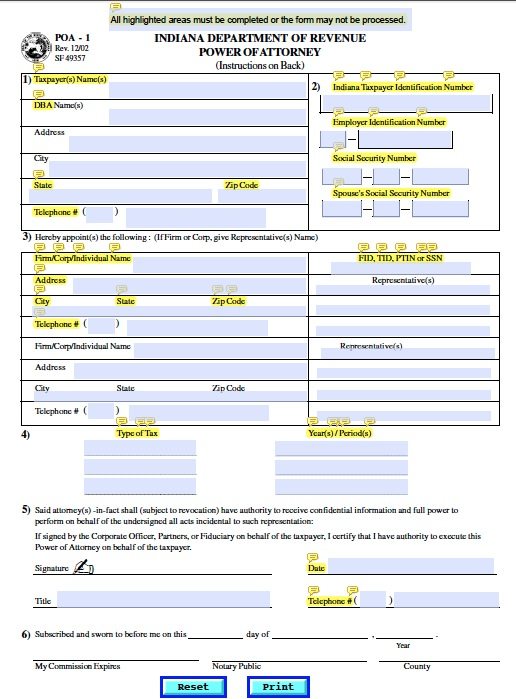

Free Tax Power Of Attorney Indiana Form Poa 1 Pdf

Long Delayed Indiana Tax Rebate Checks Will Be Larger

Form Ih 5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

Indiana Tax Rates Rankings Indiana State Taxes Tax Foundation

Most Popular Tax Deductions In Indiana March April 2011

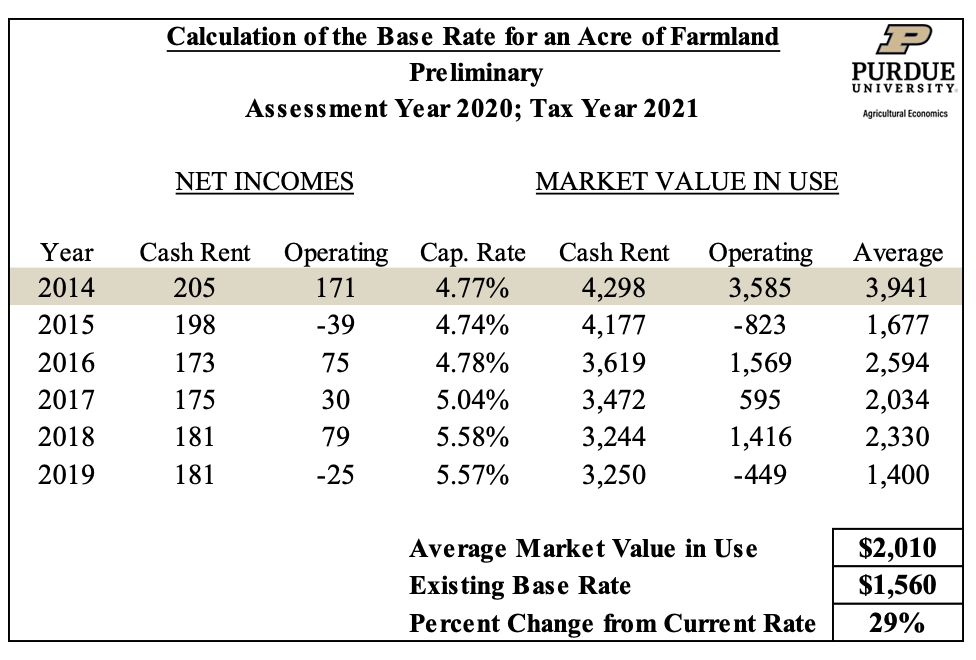

The New Age In Indiana Property Tax Assessment

Free Free Hawaii Real Estate Purchase Agreement Template Pdf Property Sale Agreement Templat Contract Template Purchase Agreement Indiana Real Estate

Indiana State Tax Information Support

Eli Manning Lists Giant New Jersey Estate For 5 25m

Indiana Sales Tax Small Business Guide Truic

Free Indiana Tax Power Of Attorney Form 49357 Pdf Eforms

Farmland Assessments Tax Bills Purdue Agricultural Economics

Income Tax Hgtv Dream Home Hgtv

Indiana Tax Rates Rankings Indiana State Taxes Tax Foundation

Indiana Estate Tax Everything You Need To Know Smartasset

16 Printable Indiana State Tax Withholding Form Templates Fillable Samples In Pdf Word To Download Pdffiller