kern county property tax phone number

Kern County Home Property Tax Statistics. Taxes - Sample Bill Calculations.

Career Opportunities Sorted By Job Title Ascending Superior Court Of California County Of Kern

Visit Treasurer-Tax Collectors site.

. KCTTC Taxpayer Service Center PO. Find Kern County Property Records. Business Personal Property.

Name Kern County Recorder of Deeds Address. The Kern County Treasurer-Tax Collectors Office located in Bakersfield California is responsible for financial transactions including issuing Kern County tax bills collecting personal and real. You can pay online by phone or by mail.

Find Kern County Home Values Property Tax Payments Annual Property Tax Collections Total and Housing Characteristics. Kern County Probation Collection Revenue. Kern County Property Records are real estate documents that contain information related to real property in Kern County California.

Kern County Home Property Tax Statistics. Find Kern County Home Values Property Tax Payments Annual Property Tax Collections Total and Housing Characteristics. 1115 Truxtun Avenue Bakersfield CA 93301-4639.

How to Use the Property Search. KCTTC 1115 Truxtun Ave. Supplemental Assessments Supplemental Tax Bills.

800 735-2929 or 711 How to Use the CA Relay Service CRS. Alameda County Superior Court. 661-868-3303 BusinessOil and Gas Fax Number.

Enter an 8 or 9 digit APN number with or without the dashes. 661-868-3485 Real Property Fax Number. 800 735-2929 or 711 How to Use the CA.

Box 579 Bakersfield CA 93302-0580. Kern county property tax phone number Saturday March 26 2022 Edit Address. Address and Phone Number for Kern County Recorder of Deeds a Recorder Of Deeds at Chester Avenue Bakersfield CA.

Auditor - Controller - County Clerk. Fillable Online Kcttc Co Kern Ca Business. 800 AM - 500 PM Mon-Fri 661-868-3599.

Alameda County Central Collections. Kern County Administrative Office 1115. Enter a 10 or 11 digit ATN number with or without the dashes.

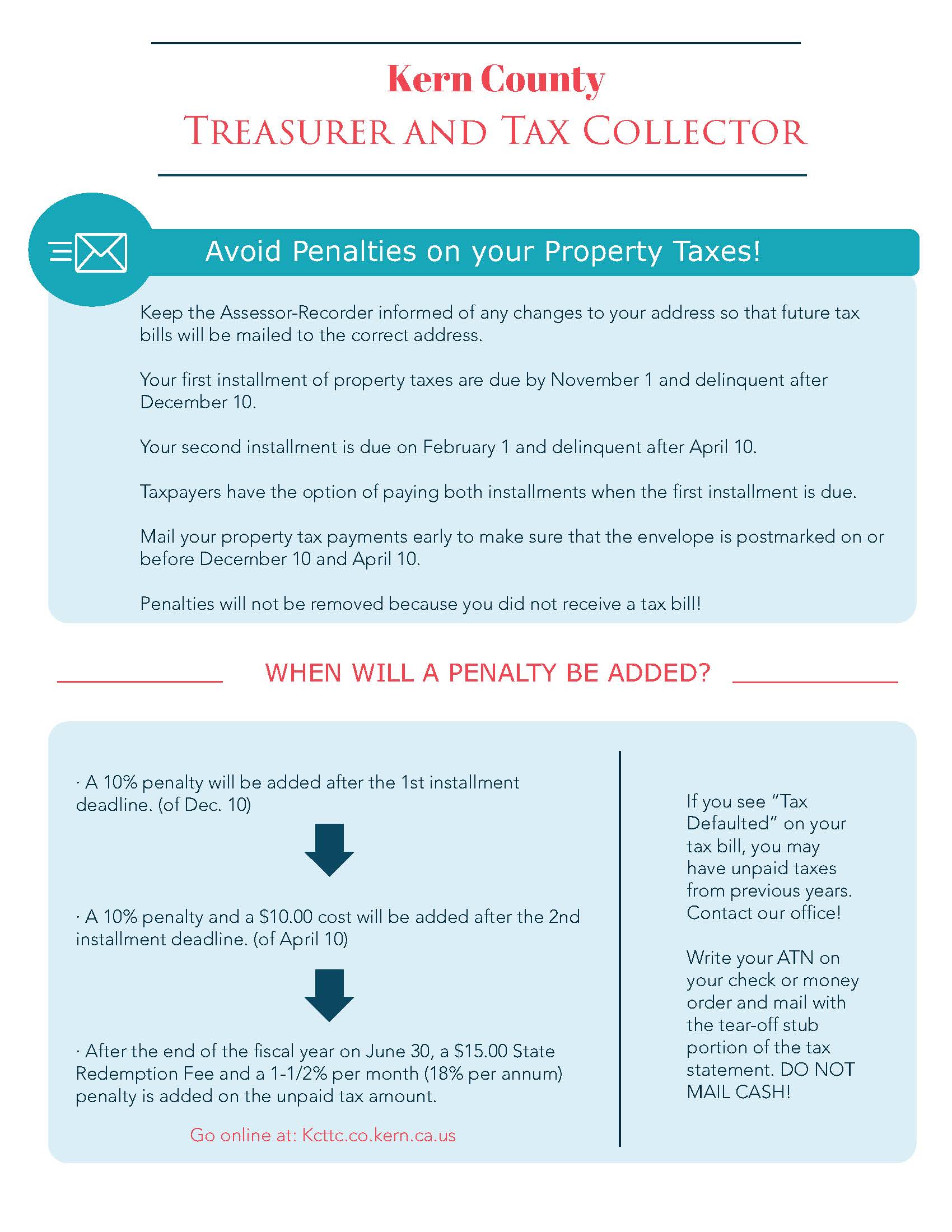

Suggested annual investment guidelines are based on the number of employees OR the amount of Kern County property taxes paid whichever is higher. If you have any questions about Kern County property taxes please contact the Tax Collectors office at 661 868-3585. Payment of Property Taxes is handled by the Treasurer-Tax Collectors office.

Internet Tax Payment System. Assessor Office 1115 Truxtun Avenue Bakersfield CA 93301 Monday -. Exclusions Exemptions Property Tax Relief.

INTERACT WITH KERN COUNTY Contact Us Email Notifications Website Feedback.

Kern County Board Of Supervisors Approve 2022 2023 Fiscal Budget Kbak

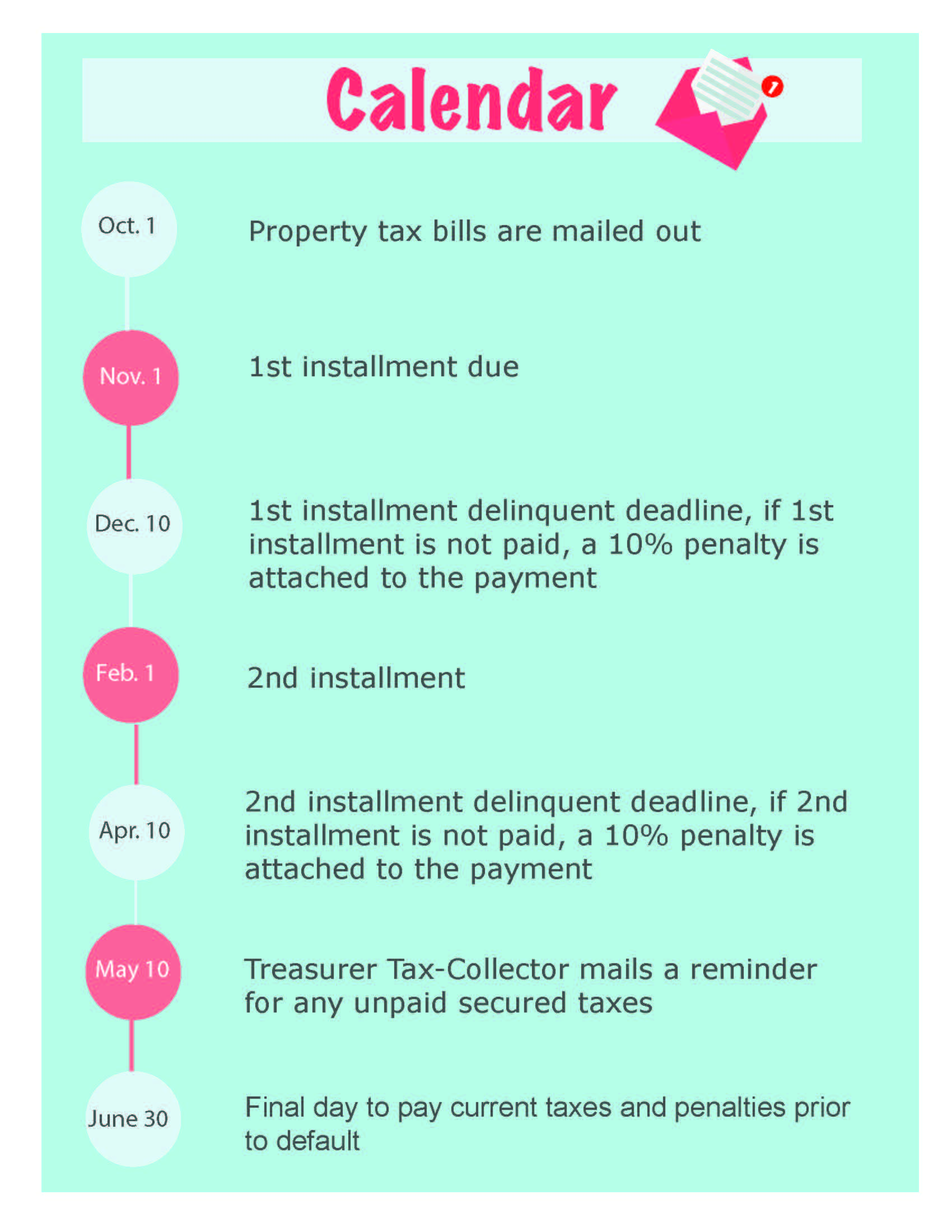

Kern County Treasurer And Tax Collector

Stub Coupon Design For Efficient Processing By Kern County Jordan Kaufman Assistant Treasurer Tax Collector Eric Pitts Technology Services Manager Ppt Download

Kern County Treasurer And Tax Collector

County Bundles Trash Collection Tax Into Residents Property Tax Bills Kern Valley Sun

Kern County Treasurer And Tax Collector

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

Solar Charges Make Kern Whole In State Tax Dispute News Bakersfield Com

County Of Kern On Twitter Kern County Treasurer And Tax Collector Jourdan Kaufman Recently Announced The Extension Of The Property Tax Deadline From April 10th 2020 To May 4th 2020 Https T Co Ajxspn38xm

Kern County Assessor Recorder S Office Facebook

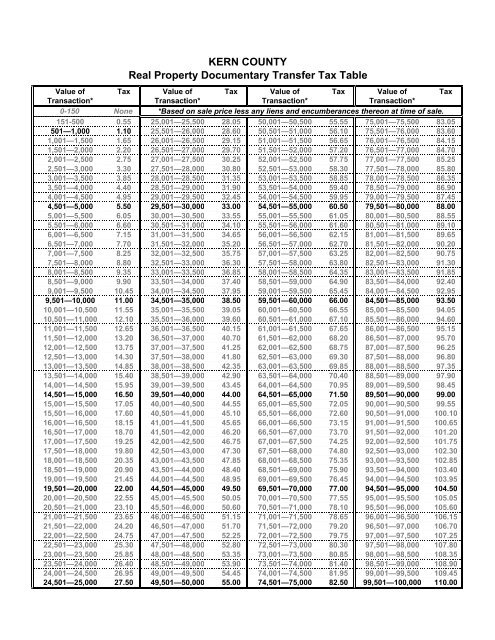

Tax Table Kern County Assessor Recorder

Kern County Treasurer And Tax Collector

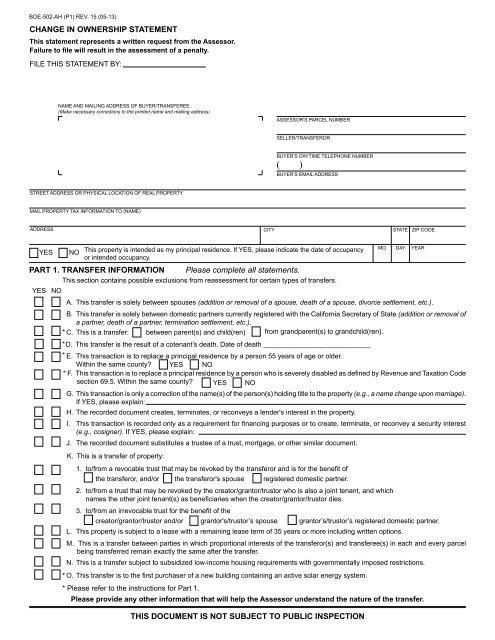

Form Boe 502 Ah Kern County Assessor Recorder

Kern County Ca 2021 Tax Sale Over 1 500 Properties Deal Of The Week Youtube

California S Kern County Has To Find Tax Revenue If Oil Drilling Ends The New York Times

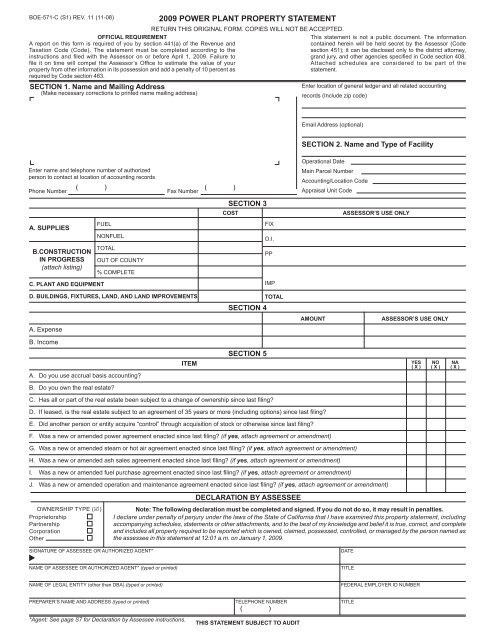

Power Plant Property Statement Kern County Assessor Recorder

Kern County Auditor Controller County Clerk

Kern County Treasurer And Tax Collector

Kern County Assessor Taxable Property Values Increased 11 7b Versus Previous Year Kern Valley Sun